In Microsoft Dynamics 365 Business Central TDS can be applied in purchase invoice and vendor payment documents, suppose TDS has applied on a purchase invoice documents which invoice value is 10000 and TDS has applied 10.00 %, 1000 TDS value.

Now suppose purchase credit note has posted against posted purchase invoice document of 5000 value, then TDS also need to reverse.

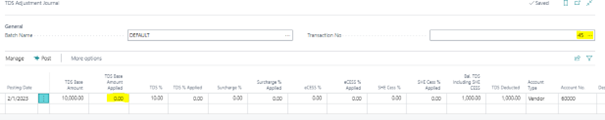

But TDS is not being applied in purchase credit note, so we use TDS adjustment journal functionality. Open TDS adjustment functionality and select TDS entry No in Transaction No. and put amount 5000 in ‘TDS Base Amount Applied ‘system calculate TDS % applied and reflect value in Amount field accordingly.

TDS Entry before posting TDS adjustment.

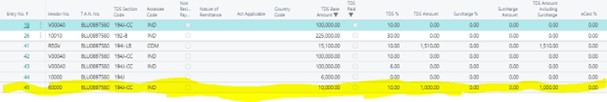

TDS Entry after posting TDS adjustment.