💡 TDS on Year-End Provisional Entries in Business Central

Introduction

Under TDS (Tax Deducted at Source) regulations, TDS must be deducted when the amount is paid or credited to the payee's account, whichever comes first. When an amount is credited to a provisional account, it is considered as credited to the payee's account, and TDS must be deducted accordingly.

Therefore, TDS should be deducted even on provisions made in the books of accounts to which TDS provisions apply. A provisional entry for expenses is used to record a calculated or budgeted expense in the accounting system before it is incurred or paid.

A provisional entry should be posted first, followed by the actual entry. Once the actual entry is posted, the provisional entry should be reversed. As per the requirement, TDS should be calculated on the provisional entry. When the actual entry is posted, the system should not calculate TDS again, since it was already deducted on the provisional entry.

Process

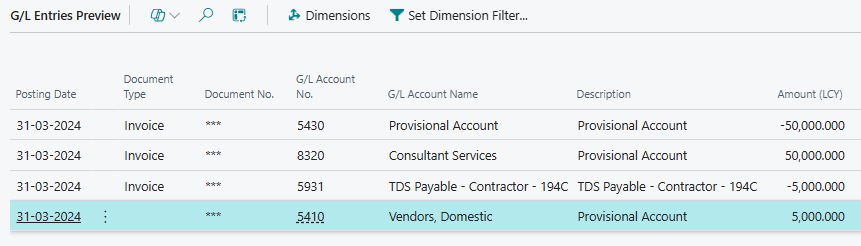

In this scenario, we assume creating and posting a provisional entry for an expense of ₹50,000 in March 2024, with the bill to be received after April 2024. TDS at 10% should be calculated on the expense amount.

📌 Provisional Entries via GJ

- Document type – Invoice

- Party type – Vendor

- Party code – Vendor ID (e.g., V00100)

- Account type – G/L Accounts

- Account – Provisional Account (e.g., 5430)

- Amount – (50,000) (in Negative)

- Bal. Account type – Expense Account

- Location State code – MH

- Provisional Entry – Mark checkbox

- TDS Section code – 194C

- Gen. Posting type – Purchase

- Gen. Bus. Posting Group – Required

- Gen. Prod. Posting Group – Required

- Location code – Required

- T.A.N No – Required

Note: Since the above entry is being posted at year-end in March, we will process the TDS payment to the government for the last quarter of the year. The process outlined can also be used for monthly provisional expenses. In such cases, the TDS payment entry will not be part of these transactions.

💰 TDS Payment Entry via Payment Journals

In Business central user will pass Payment Journals for TDS payment with below details: -

- Document type – Payment

- Account type – G/L Accounts

- Account Number – 5931 (TDS GL account for section 194C)

- Payment Method Code – Required

- Location code – Required

- T.A.N. No – Required

- T.C.A.N No – Required

- Bal. Account type – Required (Bank)

- Bal. Account Number – Required

- Click Pay TDS → TDS

- Click on Pay

- System will update the amount.

🧾 Actual Invoice via Purchase Journal

- Document type – Invoice

- Account Type – Vendor

- Account No – Required (Select the same vendor that was chosen when creating the provisional entry)

- TDS section – Blank

- Balance Account – Actual Expense Account (in this case 8320)

- Amount – (-50,000) (actual amount used in provisional entry)

- Location code – Same as Provisional Entry

- External Document Number – Required

- Click on Action ➡ Apply Provisional Entry → Select related entry → Click on Apply.