Input Service Distributor (ISD) is an office of the supplier which distributes credit Input Services (CGST, SGST and/IGST) to various locations of the supplier. The recipient locations can be inter-state or intra-state, but they should have the same PAN as that of the distributing location. GST Input Service Distribution functionality can be used to distribute CGST & SGST/IGST paid on Input services (Input Tax Credit) to other locations. This functionality is applicable only for Services.

System does not allow posting any sales transactions for a location if it contains a registration number which has GST Input Service Distribution activated.

Following is the lists of setups that are required to be configured.

- GST Registration

- Locations

- General ledger setup

- Source code setup

- GST Posting setup

- GST Component Distribution

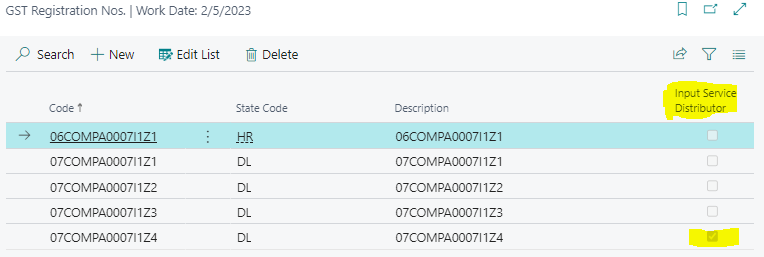

GST Registration –

GST No has define as ISD in GST registration.

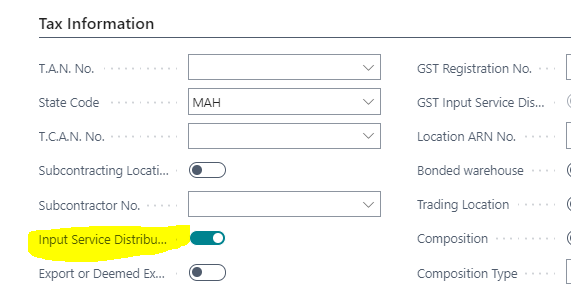

Locations Setup –

ISD is defined in tax information tab on location to identify that location is used for input service distribution.

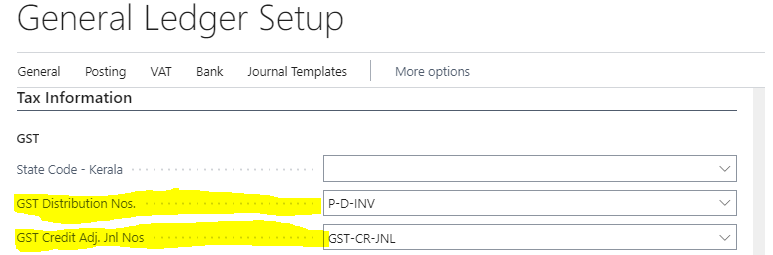

General ledger Setup –

Define GST distribution No series in general ledger setup.

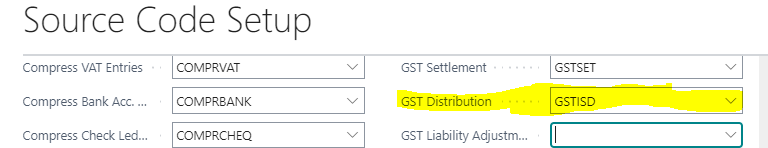

Source Code Setup –

This setup is required to define the source code for distribution.

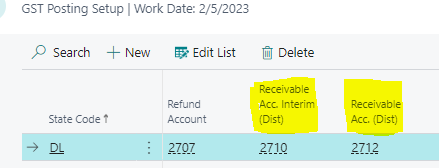

GST Posting Setup –

This setup is required to define the general ledger accounts for distribution.

Receivable Acc. Interim Dist. Specify the relevant general ledger account.

Receivable Acc. Dist. Specify the relevant general ledger account.

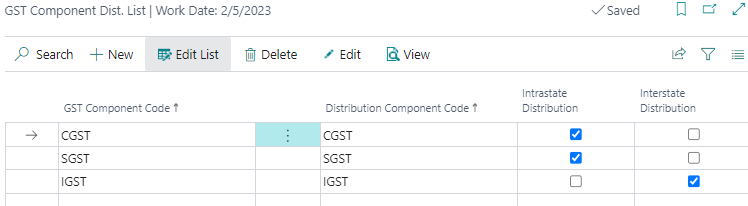

GST Component Distribution setup.

This setup is required to define the GST components for distribution functionality.

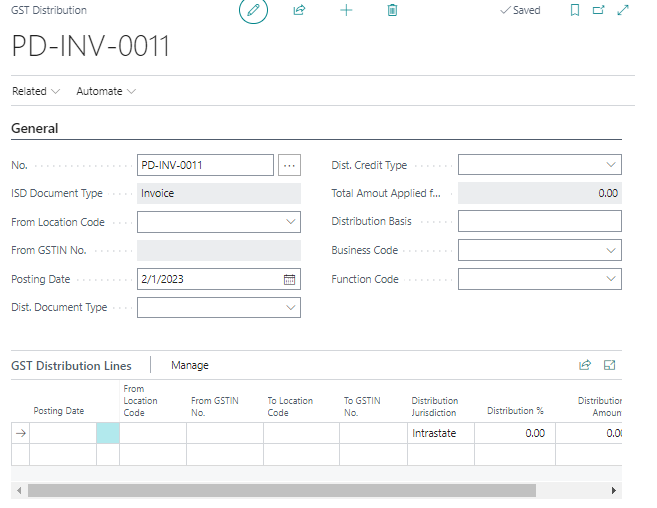

Input Service Distribution Process.

GST Input Service Distribution functionality is used to distribute CGST & SGST/IGST paid on Input services (Input Tax Credit) to other locations.

Open GST Distribution List, from related link.

- Following fields should be filled on the General Tab

- Following fields should be filled on the GST Distribution Line Tab

| Field |

Description |

| No. |

Specifies the unique number for the document. |

| ISD Document Type |

Specifies the relevant document type of the transaction. |

| From Location Code |

Specify the location code from where input credit will be distributed. |

| Posting Date |

Specifies the posting date of the document. |

| Distribution Document Type |

Specifies the type of the document. |

| Dist. Credit Type |

Specifies the distribution credit type. |

| Total Amount Applied for Dist. |

Specifies the total amount which is applied for distribution. |

| Distribution Basis |

Specifies the distribution basis. |

| Field |

Description |

| Posting Date |

Specifies the posting date of the document. |

| From Location Code |

Specifies the location code from where input credit will be distributed. |

| From GSTN No. |

Specifies the GST registration number of the location defined in the From Location Code. |

| To Location Code |

Specifies the location code to which input credit will be distributed. |

| To GSTN No. |

Specifies the GST registration number of the location defined in the To Location Code. |

| Distribution Jurisdiction |

Specifies the distribution jurisdiction, Interstate, Intrastate. |

| Distribution % |

Specifies the distribution percentage. |

| Distribution Amount |

Specifies the distribution amount. |

| Rcpt. Credit Type |

Specifies whether the input credit is available or not. |