Case1 - TDS calculation on vendor advance payment

Check Vendor master PAN is available or not because TDS % is applicable according to PAN and Non-PAN.

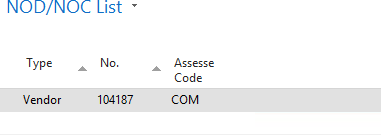

Check Nod list for TDS setup for that vendor for which you want to deduct TDS.

Open Bank payment voucher and put vendor detail, amount, TAN No., TDS Nature of Deduction and Balance account as below print screen.

TDS applied on amount value 12000.00 entry is as below -

| Posting Date |

Document Type |

Document No. |

G/L Account No. |

G/L Account Name |

Amount |

| 27-01-2023 |

Payment |

*** |

14570 |

Bank of India |

11,760.00 |

| 27-01-2023 |

Payment |

*** |

25010 |

TDS Payable-Contractors |

-240 |

| 27-01-2023 |

Payment |

*** |

17010 |

Staff. Advance |

12,000.00 |

Case2 - TDS calculation on vendor advance payment on net amount (Amount Excl. GST)

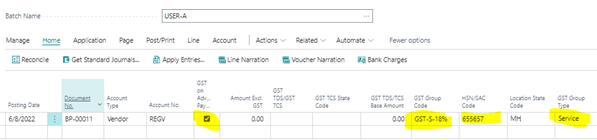

Open Bank payment voucher and put vendor detail, amount, TAN No., TDS Nature of Deduction and Balance Amount Excl. GST, account as below print screen.

.png)

Suppose 12000.00 has to pay to vendor but want to deduct TDS only on 10000.00 then put 10000.00 in ‘Amount Excl GST’ calculate TDS and check entry. Entry would be like as below.

| Posting Date |

Document Type |

Document No. |

G/L Account No. |

G/L Account Name |

Amount |

| 27-01-2023 |

Payment |

*** |

14570 |

Bank of India |

11,800.00 |

| 27-01-2023 |

Payment |

*** |

25010 |

TDS Payable-Contractors |

-240 |

| 27-01-2023 |

Payment |

*** |

17010 |

Staff. Advance |

12,000.00 |