💰 Calculating GST on Bank Charges with G/L Account in Dynamics 365 Business Central

Bank charges are a common part of business transactions—and so is GST (Goods and Services Tax) on those charges. But how do you properly calculate and account for GST on bank charges directly within Dynamics 365 Business Central?

This guide walks you through the step-by-step process of booking bank charges with GST using a G/L account in a Bank Payment Voucher, along with screenshots and examples.

✅ Prerequisites

This feature is available in:

Business Central Cloud

Business Central On-Premises

What Is It About?

Typically, bank charges are entered via a general journal or payment voucher. However, when GST is involved, just debiting the bank charge account isn't enough—you must also calculate and apply the correct GST amount, while ensuring it reflects properly in G/L entries.

This blog shows how to:

Book bank charges with a G/L account

Apply GST using the built-in Bank Charges journal

Reflect the correct GST impact in the financial statements

🛠️ Step-by-Step Setup

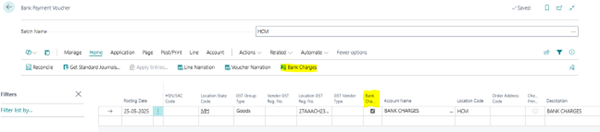

🎯 Step 1: Create the Bank Payment Voucher

Go to Bank Payment Journal and create a new line with the following:

Document Type: Payment

Account Type: G/L Account

Account No.: Select your Bank Charges G/L Account

Bal. Account Type: Bank Account

Bal. Account No.: Choose the relevant Bank Account

This creates a basic bank charge entry—but without GST just yet.

🎯 Step 2: Enable the GST Calculation

Look for a Boolean field called "Bank Charge" in the journal line.

✅ Set this field to True. This tells Business Central to calculate GST on this transaction.

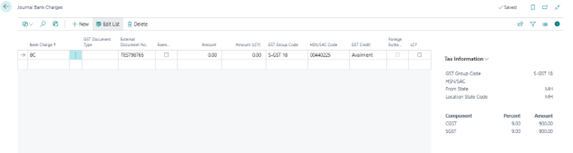

🎯 Step 3: Define GST Details

After enabling the Bank Charge field:

Click on the Bank Charges button (visible in the ribbon).

This opens the Journal Bank Charge page.

Here, fill in the required GST details:

Bank Charge Code

External Document No.

GST Group Code

HSN/SAC Code

GST Credit: Set to Availment (if claiming input credit)

You’ll see that GST is calculated automatically.

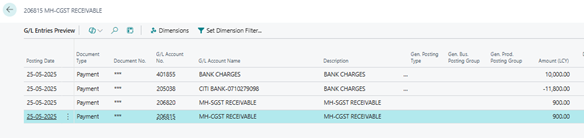

💡 Example Scenario

Scenario:

Bank Charge: ₹10,000

GST Rate: 18%

Bank Charge Code: Defined as per your setup

The bank account is credited with ₹11,800, and the system records both the base charge and the tax components accurately.